missouri employer payroll tax calculator

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP For Payroll Benefits Time Talent HR More.

2022 Federal State Payroll Tax Rates For Employers

Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

. What does eSmart Paychecks FREE Payroll Calculator do. Employees can use the calculator to do tax. Get Started With ADP.

The Missouri hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck. Choose Marital Status Single or Dual Income Married Married one income Head of Household. Get Started With ADP.

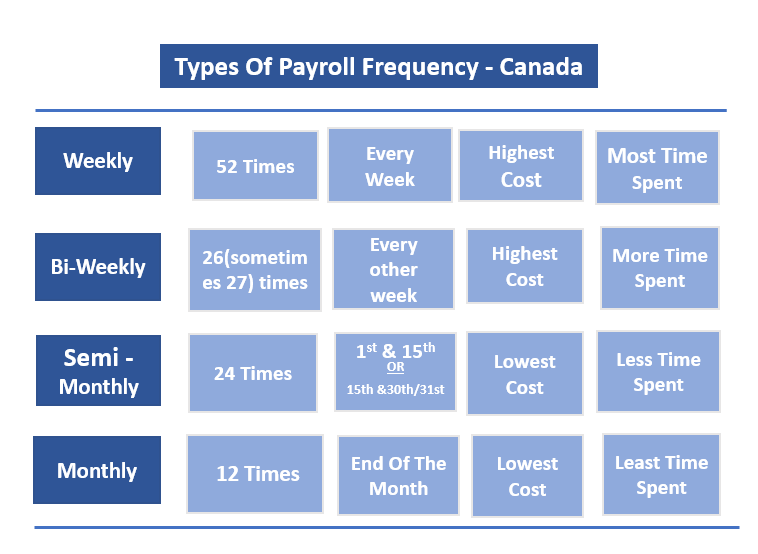

Withhold 62 of each employees taxable wages until they earn gross pay. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Employers covered by Missouris wage payment law must pay wages at least semi-monthly.

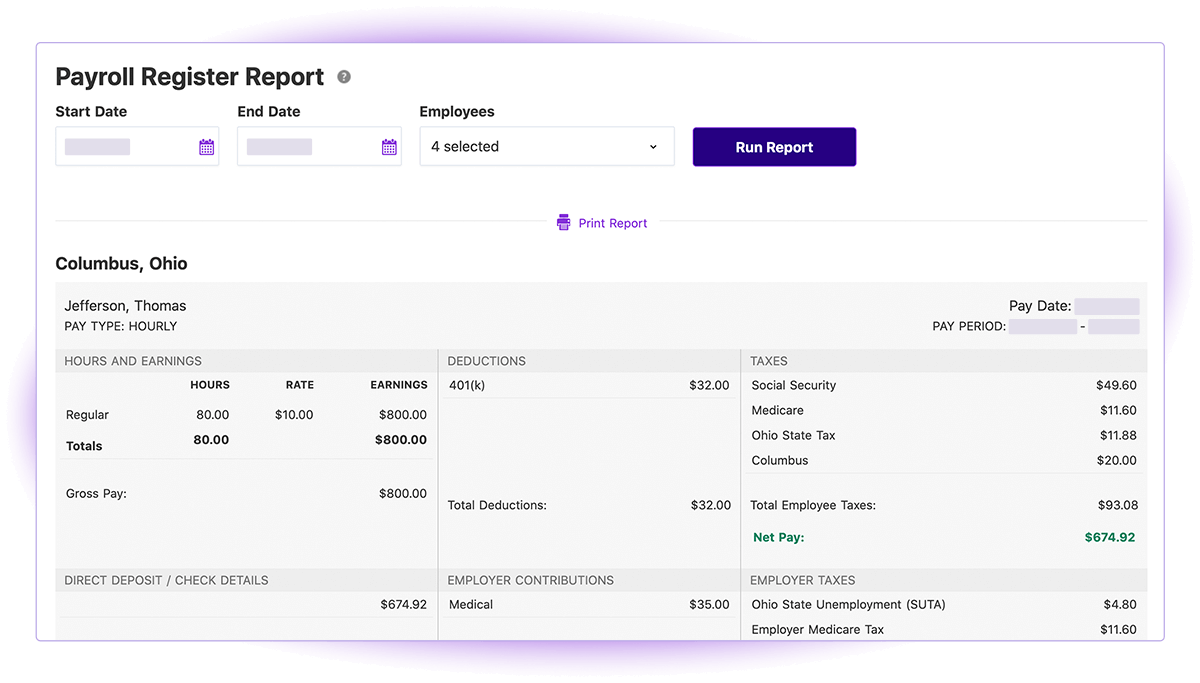

Select the Hourly option under Pay Type enter the employees pay details and watch the magic happen. Number of Qualifying Children under Age 17. The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time.

It is not a substitute for the advice. Missouri new hire online reporting. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Check if you have multiple jobs. Complete an updated MO W-4 and submit to your employer. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

The standard FUTA tax rate is 6 so your max. Missouri does not have any reciprocal agreements with other states. 537 N 3rd St Hammonton NJ 08037 2 Bed 1.

Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri. Salary Payroll Calculator If you pay your employees a salary choose the Salary Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals. There are Kansas City earnings taxes of 1 that are withheld from the.

Missouri is currently not a credit reduction state. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. Missouri Paycheck Calculator Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Additions to Tax and Interest Calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Missouri residents only. Missouri Cigarette Tax.

Employees with multiple employers may refer to. Taxes to withhold Your Missouri State Taxes to withhold are Need to adjust your withholding amount. Missouri Resources Missouri calculators Missouri tax rates Missouri.

That tax rate hasnt changed since 1993. Just enter the wages tax withholdings and. Discover ADP For Payroll Benefits Time Talent HR More.

Missouri Paycheck Calculator - SmartAsset SmartAssets Missouri paycheck calculator shows your hourly and salary income after federal state and local taxes. All corporations and manufacturers doing business in the state. Missouri Payroll for Employers.

Local taxes are imposed in Missouri. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Enter your info to see your.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Payroll Template

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Bookkeeping Business Money Lessons

2022 Federal Payroll Tax Rates Abacus Payroll

Solved Employer Payroll Tax Expense Account

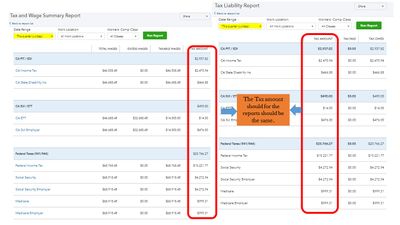

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax What It Is How To Calculate It Bench Accounting

Salary Paycheck Calculator Calculate Net Income Adp

Everything You Need To Know About Running Payroll In Canada

What Is Local Income Tax Income Tax Income Tax

Online Payroll For Small Business Patriot Software

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Software For Small Business Patriot Software

How To Do Payroll Yourself For Your Small Business Gusto

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax What It Is How To Calculate It Bench Accounting

Teks Lesson Plan Template Best Of 62 Free Pay Stub Templates Downloads Word Excel Pdf Doc Lesson Plan Templates Teks Lesson Plans Downloadable Resume Template