jersey city property tax delay

A vacation home at the beach is a great place to get away for weekend respites or long summer stretches. After the burial some critics pointed out that by using an area of the golf course as a cemetery the Bedminster property could be eligible for tax breaks under New Jersey law.

Coronavirus Jersey City Cases Updates And More May 2022 Jersey City Upfront

This is especially likely in high-tax high-cost states like New Jersey where a 600000 home with an effective 4 property tax rate carries a 24000 annual tax burden.

. Tax on certain types of income you must attach a statement to Form W-9 that specifies the following five items. Typically the program operates as a loan with interest. Paramus p ə ˈ r æ m ə s pə-RAM-əs is a borough in Bergen County New Jersey United StatesA bedroom community of New York City Paramus is located 15 to 20 miles 24 to 32 km northwest of Midtown Manhattan and approximately 8 miles 13 km west of Upper ManhattanThe Wall Street Journal characterized Paramus as quintessentially suburban.

First level include open floor plan concept with soaring 10. Harrington cited New Jersey tax code and documents the ProPublica news nonprofit published indicating tax exemptions in place since May 2016 for whats deemed a nonprofit cemetery service. A property tax deferral program allows you to delay your property tax payments.

Both third party and governmental websites are now able to offer public records with increased reliability thanks to the initiative to digitize public records. A process that began three decades ago. Property Tax Deferral for Seniors.

Covering NYC New Jersey Long Island and all of the greater New York City area. A DUI offender under 17 years of age and unlicensed at the time of the incident is further subjected to a 3090-day delay in processing. Below we list the state tax rate although your city or county government may add its own sales tax as well.

Generally this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Certain events and circumstances can delay or toll statutes of limitations essentially lengthening the time period for bringing a claim. An ordinance of the city of jersey city in the county of hudson state of new jersey authorizing the transfer of certain city-owned real property identified on the tax map of the city of jersey city as block 2190101 lots 1 4 6 8 and 9 and block 21901 lot 4 to the jersey city redevelopment agency.

AP The West Virginia House of Delegates on Thursday passed the Republican governors plan to reduce the state income tax by 10 setting up a clash in the Senate whose. You may be eligible if you have a limited income and you are at or above a certain age -. 469 2005 was a landmark decision of the Supreme Court of the United States in which the Court held 54 that the use of eminent domain to transfer land from one private owner to another private owner to further economic development does not violate the Takings Clause of the Fifth AmendmentIn the case plaintiff Susette Kelo sued the.

Section 544-66 - Computation of property tax rebate. Pre-foreclosures are typically listed in county and city courthouse buildings. If you are over the age of 65 the first 75000 of your homes property value is exempt.

This state has property tax relief programs geared towards retirees that allow you to delay property tax payments until your house is sold. Low-income households can also get a freeze or reduction in property taxes. New Yorks source for breaking news weather and live video.

City of New London 545 US. Section 544-63 - Definitions relative to tenants property tax rebates. 10 best places to buy a beach house in 2022.

In this case a 10 reduction in your assessed value which is. Jun 18th 2020. Section 544-65 - Computation of amount of property tax reduction.

Well review the vehicle property tax for each state in the table below. For those who qualify tax exemptions generally come in four different categories. All 50 states provide some kind of tax relief for senior.

How much time do you have to bring a legal action in New Jersey. Now due to the intricacies of New Jerseys tax laws and how they apply to cemetery companies some say the course could be getting a tax break. 2A14-1 2020 Slander.

2 For the tax periods beginning on or after January 1 2006 the minimum tax is based on New Jersey Gross Receipts as follows except for corporations that are members of affiliated groups with total payroll of 5000000 or more whose minimum tax is 2000 annually see 5b1 above. New Jersey Gross Receipts Minimum Tax for period begin. Some states require you to pay an annual tax on the value of your vehicle.

Property Tax Exemptions for Senior Citizens in Different States. Northampton County Council delayed a vote on a tax-break for redevelopment of the old Dixie Cup property Thursday pending consideration of another version that is. 3550-84 based on weight and age of vehicle.

Contained in the saving clause of a tax treaty to claim an exemption from US. Enter the property through the finished foyer space w ELEVATOR leading to a flex room with endless possibilities. Section 544-67 - Payment of property tax rebate credit.

Texas began creating public records as far back as 1839 and they usually contain information from the states 254 counties. Section 544-64 - Property tax rebate to tenants by owner of qualified real rental property. Your state pays your taxes and charges you interest.

Pavonia Branch Jersey City Free Public Library

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Welcome To Ocean City New Jersey America S Greatest Family Resort Tax Collection

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

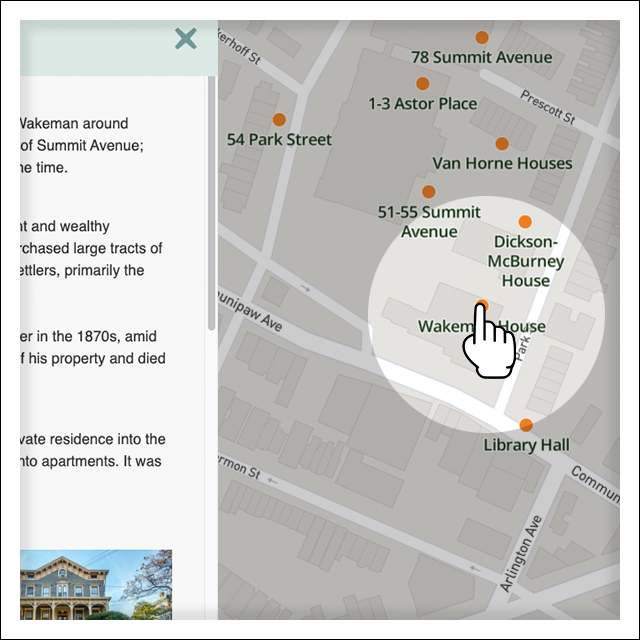

Warehouse Historic District Jersey City Landmarks Conservancy

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

Property Tax Bills Delayed Delran Township

Tax Assessor Fort Lee Borough Nj

Warehouse Historic District Jersey City Landmarks Conservancy

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library

The Official Website Of City Of Union City Nj Tax Department

Free Nj Lease Agreement Make Download Rocket Lawyer

Chapter 345 Zoning Code Of Ordinances Jersey City Nj Municode Library